What is a budget?

A budget is a financial tool that helps you assess your income and day-to-day spending, so you can set realistic financial goals. Budgeting might seem like a daunting task, but it’s one of the most effective ways to take control of your finances and ensure you’re on track to meet your financial goals. Whether you’re new to budgeting or just looking to refine your approach, continue reading to learn about budgeting.

The key components of a budget include:

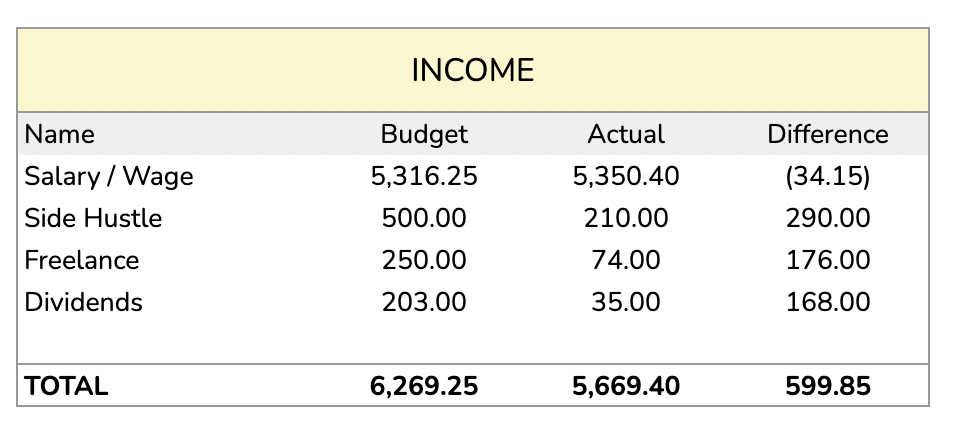

- Income – salary or wages, side hustle, dividends from investments

- Expenses:

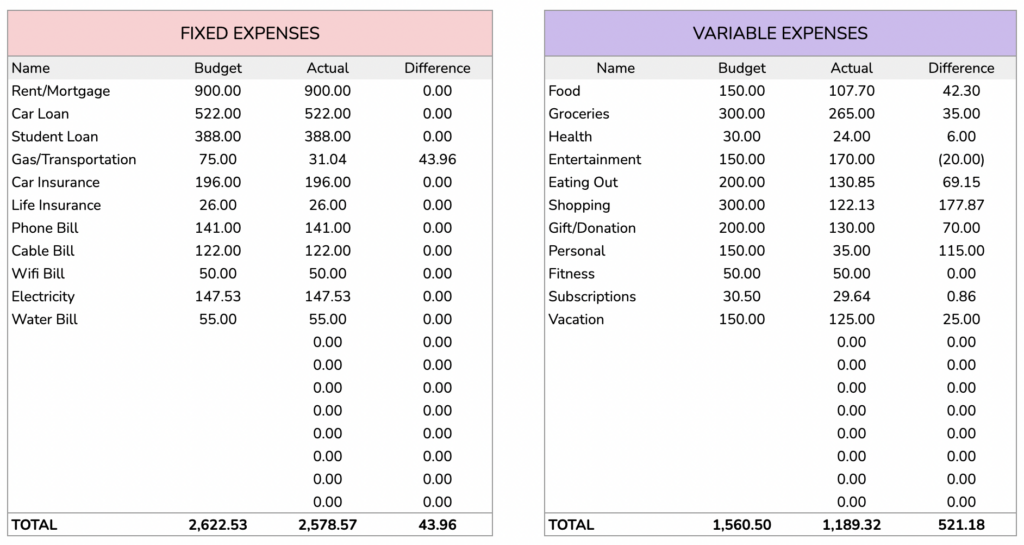

- Fixed Expenses – Rent, Utilities, Subscriptions, Car Loan, Insurance Premiums, Property Taxes

- Variable Expenses – Groceries, Transportation, Shopping, Eating Out, Entertainment, Travel, etc.

- Discretionary Spending – Hobbies, subscriptions, non-essential purchases, etc.

- Savings: Short-term Savings, Investment, Emergency Fund

Why do you need a budget?

Creating and sticking to a budget is essential because it helps you take control of your finances. A budget allows you to:

- Plan for the future: A budget allows you to allocate funds for future needs, such as retirement or vacations, ensuring you’re prepared for what’s ahead.

- Track your spending: Understand where your money goes, so you can identify unnecessary expenses and make adjustments.

- Reach financial goals: Whether you’re saving for a big purchase, paying off debt, or building an emergency fund, a budget keeps you focused and on track.

- Avoid debt: By planning your spending, you’re less likely to rely on credit cards or loans to cover expenses.

- Reduce financial stress: Knowing exactly what you have available to spend gives you peace of mind and reduces money-related stress.

Types of Budgeting

- Traditional Budgeting

This method involves dividing your spending into categories based on fixed and variable expenses, then assigning a specific budget to each category. As you track daily expenses in each category, you either stop spending once you’ve reached the limit or “transfer” funds from another category to cover the excess.

This is one of the more common budgeting types but sometimes adjusting your budgeting type based on your financial goals may be beneficial.

- Reverse Budgeting

With this method you “pay yourself first”. It prioritizes savings and financial goals over day-to-day spending. You first allocate money toward your highest priorities and then work your way down the list.

For instance, if you’re aiming to build a $6,000 emergency fund and plan to contribute $300 per month, that goal gets funded first. Afterward, you cover fixed expenses like rent and car payments, followed by discretionary spending like travel and entertainment. If you run out of funds before meeting all your expenses, adjust the variable spending first, rather than tapping into your savings.

- Zero-Based Budgeting

In this system, your income minus your expenses should equal zero. You create your budget by assigning every dollar a specific purpose—whether it’s for expenses, savings, debt, or donations—ensuring that no money is left unallocated.

How to Avoid Common Mistakes in Budgeting

If you’ve cut back on spending or increased your income but still find that your budget isn’t balancing, consider these questions to identify areas for improvement:

- Common Mistake #1: Relying too heavily on credit

Review the categories where you overspent, and carefully examine your credit card statements for unnecessary charges. - Common Mistake #2: Outdated budget

Sometimes, the issue isn’t overspending but rather rising costs for essential expenses. Make sure your budget reflects current prices - Common Mistake #3: No flexibility

It’s often wise to overestimate in a few categories (especially for unexpected expenses) rather than consistently ending the month with a shortfall in certain areas.

The Adulting Guide to Budgeting

1. Get a clear picture of your income.

Before you can start budgeting the first thing you MUST do is to get a clear picture of all your income. Everything that you earn should be accounted for. This includes:

- Primary Income: Your salary or wages from your job.

- Secondary Income: Any additional sources, such as freelance work, side hustle, rental income, dividends from investment

Be sure to calculate your total monthly income after taxes, as this is the amount you’ll be working with.

2. Track Your Expenses

To create a realistic budget, you need to know where your money is going. Track all your expenses for a month or two. You can look back at your account/credit card statement and break down all your expenses into categories such as:

- Fixed Expenses: Rent/mortgage, utilities, insurance, loan payments.

- Variable Expenses: Groceries, dining out, entertainment, transportation.

- Discretionary Spending: Hobbies, subscriptions, non-essential purchases.

Use budgeting apps, spreadsheets, or even a simple notebook to keep track. Download our expense tracker here to get started on your budgeting journey.

3. Set Your Financial Goals

Determine what you want to achieve with your budget. Goals might include:

- Short-Term Goals: Paying off credit card debt, saving for a vacation, or building an emergency fund.

- Long-Term Goals: Saving for retirement, buying a house, or funding a child’s education.

Setting clear goals helps you prioritize your spending and stay motivated.

4. Create Your Budget

With your income, expenses, and goals in mind, you can create a budget that works for you. For me a simple method that is combined with the principles of The Conscious Spending Plan found in “I Will Teach You To Be Rich” by Ramit Sethi works best for me.

What you’re going to do is…

- List Your Income: Total your monthly income.

- List Your Expenses: Categorize and total all of your expenses.

- Using the Conscious Spending Plan allow this to guide your budget

- Expenses (50-60% of income + an additional 15% to account for anything unaccounted)

- Guilt-Free Spending (20-35% of income) – this includes nights out, Subscriptions, or whatever else makes you happy.

- Investments (10% of income)

- Saving Goals (5-10% of income)

Remember, budgeting is flexible, so don’t stress about the percentages, adjust if necessary. The key is making it work for you. You can create your own budget or you can get our monthly budget spreadsheet here.

You can purchase I’ll Teach You To Be Rich by Ramit Sethi here.

5. Monitor and Adjust

Creating a budget is just the beginning. Regularly monitor your spending throughout the month to ensure you’re staying on track. If you find you’re consistently overspending in certain areas, adjust your budget accordingly.

6. Use Budgeting Tools

Consider using budgeting tools and apps to simplify the process. You can check out our personal monthly budget spreadsheet here. Other popular options include:

- Mint: Tracks spending, creates budgets, and offers financial insights.

- You Need a Budget (YNAB): Focuses on giving every dollar a job and helps you prioritize spending.

- PocketGuard: Tracks your income and expenses, showing how much disposable income you have.

7. Review and Reflect

At the end of each month, review your budget to assess your financial progress. Reflect on what worked well and where adjustments might be needed. This regular review helps you stay aligned with your goals and make informed financial decisions.

No monthly budget for me is the same. Before I start budgeting for the next month I review my previous month and look at areas that I may have overspent and check to see where things need to be shifted. I also take into account if there has been any increase in any of my usual spending including those under fixed costs.

Next as I start to plan I check my calendar looking at any upcoming celebrations such as holidays, birthdays or reunions. That way I will also have budgeted for these things without having to cut into my unexpected costs.

Remember that budgeting isn’t about restricting yourself but spending on what matters most to you. It’s about finding a balance between saving for the future and enjoying the present.

In short, focus on what’s important, cut back on what isn’t, and make your budgeting approach one that works for your lifestyle rather than creating guilt or stress.

Start small, stay consistent, and watch as your financial health improves over time.

Happy budgeting!